Electricity

ICE is the home of electricity pricing.

Electricity is a secondary fuel. It is derived from primary energy sources such as natural gas, coal, oil, nuclear and renewable resources like solar and wind power. Secondary fuels, including electricity are produced through the conversion of primary energy sources and are not found naturally in their usable form. Importantly the price of electricity is derived from the interaction of competing primary energy sources and where applicable their carbon intensity.

Electricity Futures & Options

Explore all our electricity product guides for product specs, trading hours, expiry details, margin rates and more.

Combining our electricity, natural gas, coal, oil, carbon and energy attribute certificate futures markets on a single platform provides customers with a critical edge in navigating energy markets. This integration offers advantages in speed, improved price dissemination, and optimized margin collateral offsets. By leveraging our global network, clients can optimize their trading strategies and manage risk more effectively.

The home of energy pricing

Leading marketplace for pricing primary energies, carbon and energy attribute certificates and their derivatives.

Capital efficiencies

Margin offsets across a diverse range of energy contracts.

Risk management

Exchange transparency and clearing.

Introducing Japanese Power Futures

Japanese Power is the latest edition to our global power offering. ICE introduced Japanese Power Financial Future Contracts:

Japanese (Tokyo Area) Power Financial Base and Peak Futures

Japanese (Kansai Area) Power Financial Base and Peak Futures

These futures contracts enable clients to manage their exposure to the day-ahead auction price of the Japanese Electric Power Exchange (JEPX)for the Tokyo and Kansai areas. LNG and Coal make up 33% and 31% of Japan’s electricity generation1. Japanese power producers can benefit from trading the Japanese Power Financial Futures alongside ICE’s benchmark JKM LNG (Platts) Futures, Brent and other oil Futures and the globalCOAL Newcastle Coal Futures.

1 Japan’s Energy Issue February 2024, https://www.enecho.meti.go.jp/en/category/brochures/pdf/japan_energy_2023.pdf

Global benchmarks

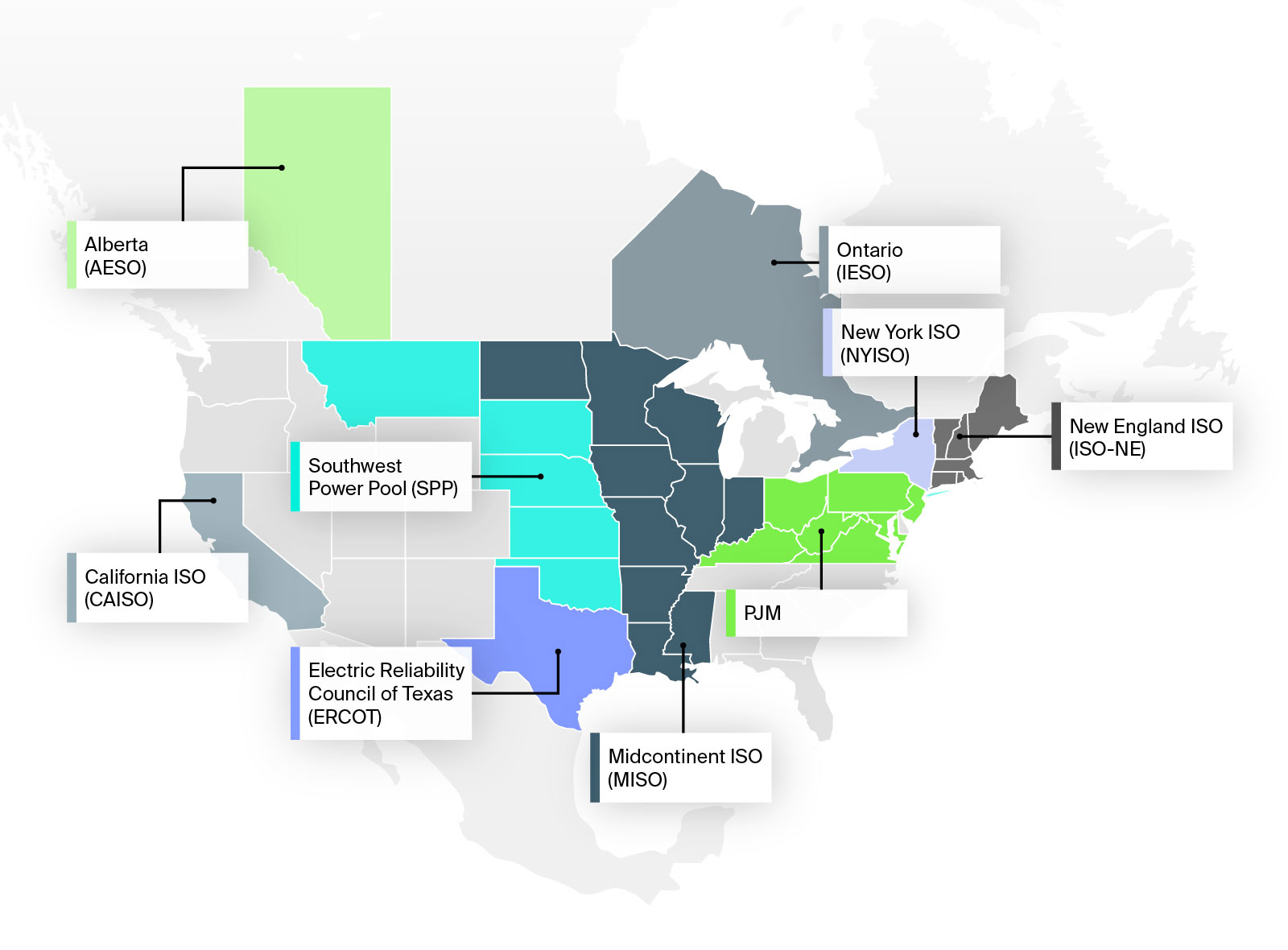

North America

futures contracts

options contracts

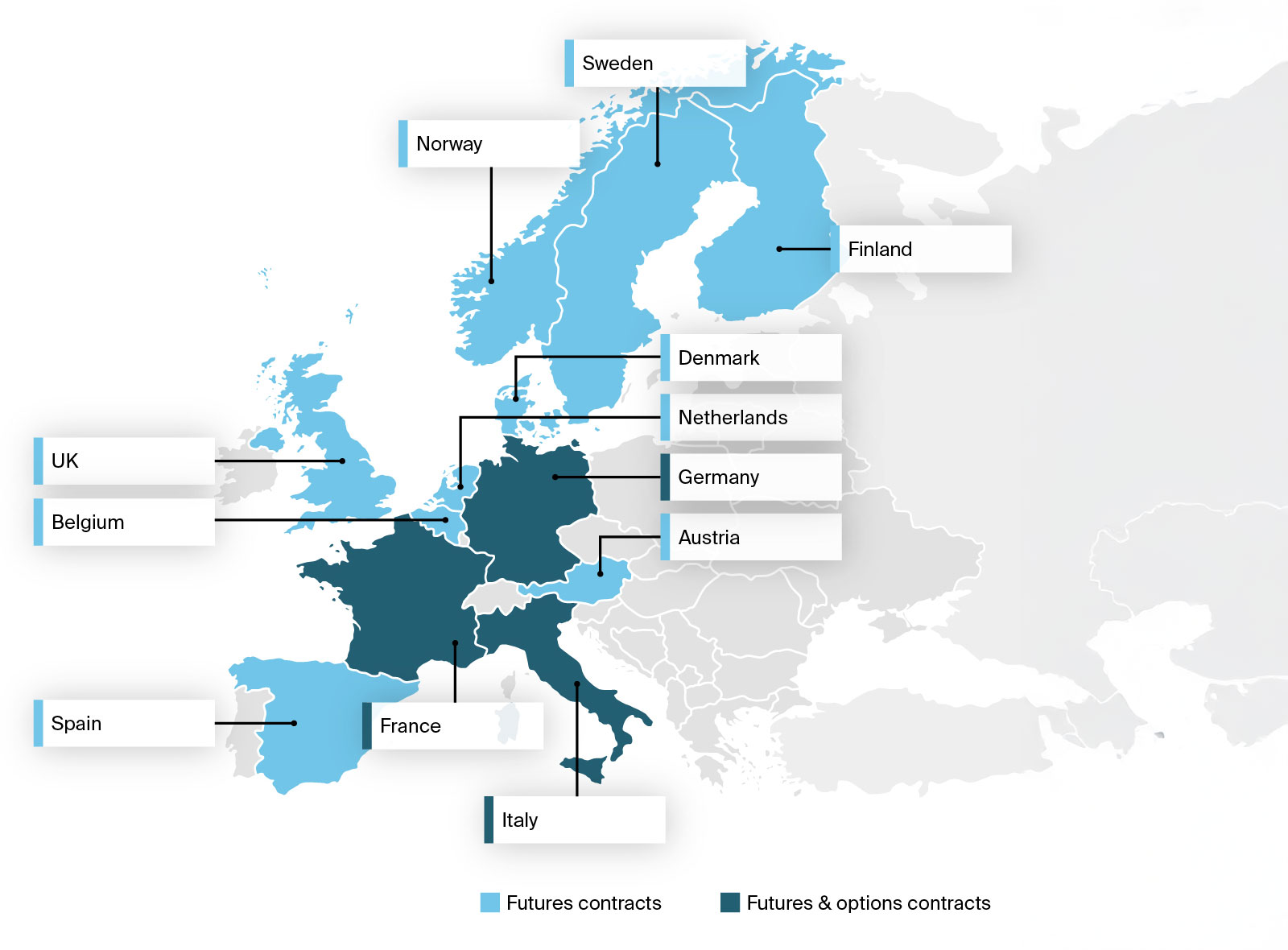

UK & Continental Europe

futures contracts

options contracts

Related insights

The globalization of natural gas gains momentum

Geopolitical shifts and a tight LNG market heighten the need to manage price and supply risks.

JKM: Diving into Asia’s natural gas benchmark

John Fry, Training Delivery Manager, ICE Education and Kenneth Foo, Asia LNG, Regional Manager, S&P Global Platts provided an in-depth analysis on the history of JKM, it’s rise as a benchmark and the importance of derivatives.

ICE Oil Markets: effective risk management for an interconnected world

Discussion of drivers behind benchmark performance for Brent, Midland WTI (HOU), Murban, Dubai, and Low Sulphur Gasoil – effective tools for risk management and investment.

The globalization of natural gas gains momentum

Geopolitical shifts and a tight LNG market heighten the need to manage price and supply risks.

JKM: Diving into Asia’s natural gas benchmark

John Fry, Training Delivery Manager, ICE Education and Kenneth Foo, Asia LNG, Regional Manager, S&P Global Platts provided an in-depth analysis on the history of JKM, it’s rise as a benchmark and the importance of derivatives.

ICE Oil Markets: effective risk management for an interconnected world

Discussion of drivers behind benchmark performance for Brent, Midland WTI (HOU), Murban, Dubai, and Low Sulphur Gasoil – effective tools for risk management and investment.